armchair quarterbacking

Long time, no post. I've been swamped with work lately, and it's gotten to the point where sometimes it lacks productivity (and I'm just working for the sake of working). So here's a short break by vomiting some thoughts about the economy. Of course, you'll know that I have no professional basis for this advice, and a lot of is based on college classes I skipped about 7 years ago.

The debt ceiling talks - wow, did it get exciting. Can't remember the last time something so procedural and common became such a prevalent part of the news. Of course, the media, facing summer doldrums (what else went on in the world? - nothing) decided to REALLY play things up. And at the end of it all, American citizens were the biggest losers. We realized our politicians are just like us - willing to put things off until the last minute to cobble together a deal that didn't change anything at all. (Do you realize that most of the savings come from winding down the Iraq/Afghanistan wars? That's like saying I'm saving a hundreds of thousands of dollars over the next 10 years by *not* purchasing an Audi R8.)

On that note, I'm not entirely convinced the debt ceiling was a real threat. If a business runs out of money, what do they do? They stop paying suppliers, then probaby the staff. Point being, they figure out which bills are important to pay, and which aren't. Had nothing happened by August 2nd, I'm pretty sure people working for/relying on the federal government would have felt a financial pinch, but the rest of us would have been OK. (No way Geithner would let those bond payments lapse)

Now, I'm all for a fiscally responsible government - and what I mean by that is an efficient one. Waste is crap. But I'm not horribly worried about deficits. The government exists as the entity of the last resort for the corporations and citizens that live within our boundaries. They have no rules they have to abide to, and I'm not sure putting in GDP cap limits is wise. It's like telling those shopaholics who run up thousands of dollars in credit card debt that the way they're going to fix their problems is by getting a CC with a lower limit. No - they're going to get their problem fixed by understanding why they need to validate their existence with buying useless crap.

That's the soul searching we need - why does America insist on spending money it does not have for entitlements and wars that serve no real purpose?

Anybody who says America is not the largest superpower in the world today is simply a cynic. We still have the dominant currency, with the most dominant economy, with the most dominant military. Our universities are the top in the world, and the Americans create the best companies in the world. The Fortune 500 contains 133 companies that are based in the US - second place? Japan and China with 60-ish. And look at the technology space. Microsoft, Apple, Google, Oracle, Facebook... all behemoths based here.

Now, I think the federal government isn't as broken as it seems. And I'm glad that we're starting to have the conversations about cutting spending. But the cutting in spending shouldn't be as a kneejerk reaction to the debt ceiling talks. The government needs a leader who will define the role of the federal government for the next hundred years. FDR (one of my favorite presidents) had the balls to push through the New Deal, which redefined American government (and the country) for the next 50 years. Now, somebody needs to take that step with us. Unfortunately Obama is not the right guy for the job, nor are any of the Republican candidates. (Obama the campaigner was definitey the right guy, though.)

Sidebar: What do I think the federal government needs to be responsible for? Safeguarding the economy, while managing "soft landings" of large industry-wide transformations. I think by and large the protection of the auto industry was a great thing - it has made Ford a great competitor, and the quality of cars has been fantastic. The government should be there as these companies slim down by providing financial, educational, and social support to those affected by these changes.

Another area that requires federal government oversight and attention is the spiraling ridiculousness that is IP - intellectual property. Things were bad enough with the "Mickey Mouse copyright" nonsense, but with the recent uprise in patent attacks, technological innovation WILL grind to a halt - and THAT is threatening "The American Way." A consortium of companies just spent $4.5 billion dollars on patents. You're telling me that money couldn't be better spent? If Friendster had IP over social networks, we'd never have Facebook today. And you're telling me that's a better world?

American ingenuity and first-to-market should be the only competitive advantages you get as an American corporation - if you want protectionism, go someplace else. The upside for giving up protectionism ideas? The largest consumer market IN THE WORLD (for now).

Health care reform is another area that the government needs to tackle - insurance and health care costs are blowing up. The problem (surprise, surprise) seems to be litigious in nature. Doctors aren't making money, health care companies don't seem to be making that much money, and I'm certainly not getting cheap health care. Insurance companies and lawyers seem to be making off with all that money. Ridicuous.

The government's role should be to root out inefficiencies and protect the markets when one group starts gaining an unfair advantage. As much as I subscribe the ideals of Adam Smith's invisible hand, I also believe that it's a pipe dream - some regulation is always necessary. (And on another side note, this is why I loved watching the Heat fail this past spring - they had EVERYTHING going for them and they fell apart).

(Back to the main premise)

Here's what scares me the most. Economic growth relies either on significant spending by one group or by technological innovation (efficiency gains). American consumers have been driving growth for the past few decades (and clearly consumer credit shows the damage). When things got bad in 2008, Americans did what they should have done: they paid down their debt. And for the past three years, the government has been picking up the spending tab with QE1 and QE2 - they injected large amounts of cash into the system to offset American consumers.. well, not being consumers.

Now, with the federal government NOT spending anymore, and American consumers still not spending... where does the money come from? Letting the dollar slide is one way of handling it - our exports become more competitive, and people in China can buy the latest Apple product, thus putting more money on Apple's balance sheet.

But here's the problem with that approach: the tax code here is so complex, it favors the insanely rich. The insanely rich can hire lawyers and accountants to find loopholes to basically not pay any income tax (this applies to both people and corporations). Now, not only is it complex... but it's high. The federal government has managed to incentivize American companies to NOT repatriate cash back to America - it's basically kept away from the American economy.

And when it's not here... well what good does it do?

Here's what needs to change: simplify the tax code, and reduce it to a much lower burden on the federal side. Make it *not* worth it for corporations to keep American money on offshore islands.

Remember how rampant file sharing was? We can look back now and safely say that the issue wasn't American consumers all being criminals - there was no viable option for purchasing music online. It is now LESS work for me to buy stuff from Apple at $0.99 (or TV episides at $2.99) then it was to pirate it.

Same goes for corporations - make it NOT worth it to not pay the taxes here in the states, by making the tax burden lower. Maybe Steve Jobs should become our chief economist advisor - he fixed the music and movie industries...

And the second benefit? Make it easier to start new businesses. Young businesses account for incredible amounts of job creation. Lower the tax burden on young businesses to help them succeed - give them signficant tax benefits for the first five years to help the company succeed as much as possible (the government will collect their dues on the income side anyways). And after five years, and the company is healthy? Give them a reasonable tax rate to pay.

The hardest part of rykorp is the amount I have to pay in taxes. After working my ass off and saving up some cash, I need to pay off the state of California and the federal government in my quarterly taxes. I'm hardly keeping anything for myself (or to grow the business). And I'm not struggling with business, either! Can't imagine how hard it is for people who have less clients than me.

Anyways - dark days seem to be ahead. I'm not sure where the economic stimulus is gonna come from - not from American consumers and not from the federal government. Pointing at corporations seem easy - last I hear, they have $1.8 trillion in cash in the bank - now THAT would be one hell of a stimulus. But - and I'm not an accountant - I don't know how much of this cash is actually in America as opposed to their balance sheets for some offshore holding company.

Of course, with the stock market looking anemic, corporations will probably largely keep that cash on hand to do stock buybacks - thus cycling more money through the financial/legal systems to create imaginary wealth instead of creating real value.

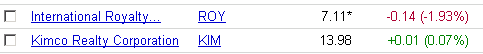

I was lucky - I needed more cash on hand for rykorp, so I sold off all my stocks a few weeks ago. The timing was fortutious, to say the least. Now, I just need to churn through business.

My outlooks? Fuck Wall Street - Main Street seems OK. The media can continue to spin yarns of the suffering of the uber-rich as stocks fall... like Wu-Tang says: cash rules everything around me. And cash is where I'll stay for a while.

(And I feel bad for anybody buying a house right now - why do people insist on trying to catch falling knives? The housing market's got a few more years before it bottoms out)