Prosper

An update on my Prosper experience so far...

I started an account early November for a Prosper account, and now I'm checking in with my first impressions now that I've gone through the process. The biggest problem with Prosper is it takes FOREVER to get anything done. It took 3 days for me to set-up an account and get it verified. It took me another 5 days to transfer funds from my bank account into my Prosper account. Then it took me about a week to get start bidding on listings and for those to close. Once a listing ends, it goes through a rigorous screening process from Prosper (to prevent fraud) and then the loan is set-up. Yesterday and today I found ~$10 deposited into my account from the first loans that were set-up.

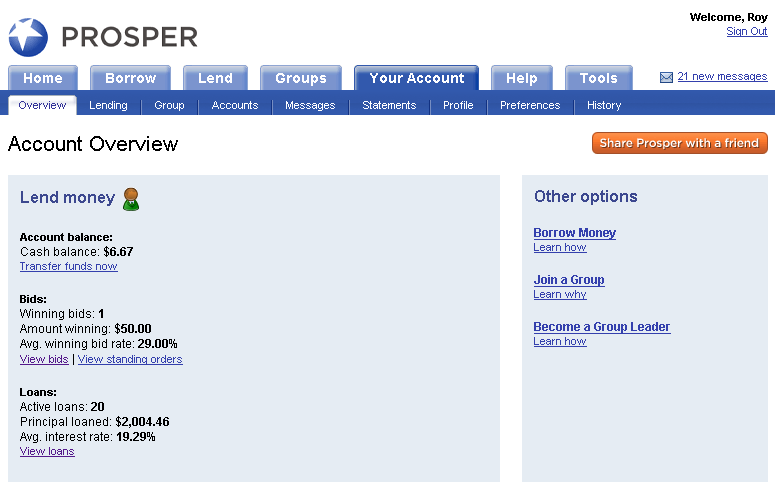

Prosper's page for looking at your existing loans is a bit obfuscated (You have to click the iconified "Lend Money" to get your overview).

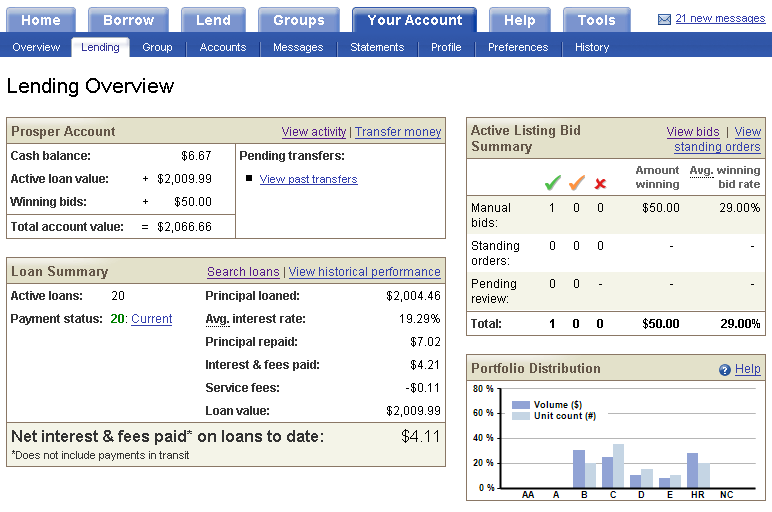

But once you find that link (it took me like my 8th or 9th login to find this screen), the following screen is incredibly useful:

This one screen can give you a quick overview of your account information.

The one thing that bugs me about Prosper (and Fidelity, too) is that there's no place to that tells you what your initial deposit was into the site. This is not a hard value to track; how about adding another field under 'Prosper Account' that says Initial Deposits?

So I'm still skeptical about the ROI on a site like this - the people you're loaning money to couldn't get loans at banks for whatever reason, which makes them high-risk (even worse if their credit rating is HR). However, you can see if I have no defaults, I'll get a ROI of 20% (not bad).

The easiest way I've found to find good listings is to follow a group. I've found a group with a high success rate called Fairplay Lending. The point of groups is for the group leader to vet for the loan - they do all the checking on the credit and the financials to make sure the loan is a sound one. I'm inherently trusting the group leader of this particular group to do the research for me, and I'm putting my money to work there.

It seems a bit risky, I know ... but it's really no different than trusting analysts for stocks (shady); if I want to do my own diligence, I can. But in the absence of that, I trust other people to do their due diligence. In the case of Fairplay Lending, the group leader is also an active bidder in almost all of the groups' loans, which gives the leader some incentive to make good investments ;)

My one big complain about Prosper: No interest returned on money that's just sitting there. Once they even return a meager 3 or 4% on the money (of course, this opens the door on whether companies have a right to invest float), I really think this will be the perfect site for loaners.

I'll try to write another post about Prosper about six months from now with my loan performance. Hopefully when they start defaulting I can learn some lessons :)

Comment with Facebook

Want to comment with Tabulas?. Please login.

spaceinthewho

it reduces the need to immediately find another loan to put your money into since you're still earning the bank interest you'd have been earning if you hadn't been loaning stuff out.

roy

spaceinthewho

PM5K (guest)